Forum Replies Created

-

AuthorPosts

-

Alan Northam

ParticipantWhat David said: “Thank you very much for taking the time to give such a full explanation. I guess it’s just bad timing then. I will persist with EAs. I’ve already posted a question on the Forum about the FTMO Robot. So if I’m lucky and qualify during some good months is it a matter of making hay while the sun shines and then getting wiped out during a bad one for failing to make enough profit? Once qualified does FTMO allow us to tread water during a bad month? Thanks again.Thank you very much for taking the time to give such a full explanation. I guess it’s just bad timing then. I will persist with EAs. I’ve already posted a question on the Forum about the FTMO Robot. So if I’m lucky and qualify during some good months is it a matter of making hay while the sun shines and then getting wiped out during a bad one for failing to make enough profit? Once qualified does FTMO allow us to tread water during a bad month? Thanks again.”

It is not bad timing as we cannot predict the future. What we can do is try to minimize the risk. One way to do that is to look at the EA Report and look to see if the EA has gone through a drawdown recently. If so then it might be OK to start trading it. In other words, analyze the report and make a sound decision as to whether or not to trade the EA.

Once the FTMO account is funded you can decide whether to trade it or not.

Alan Northam

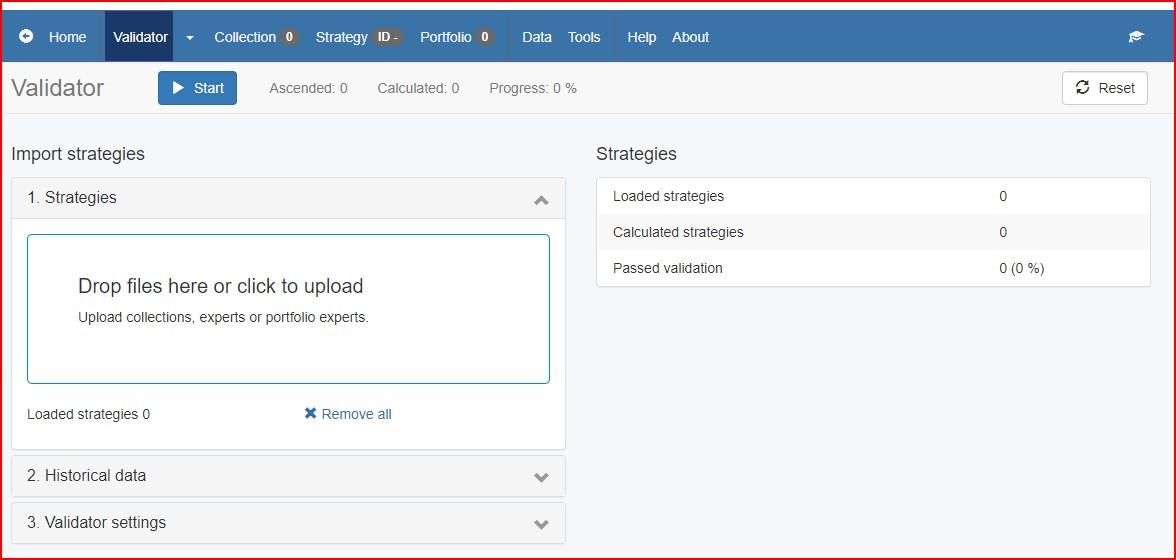

ParticipantSimon,

Select Validator and drag and drop EAs into the Strategies box.

Or, Click on the Strategies box, navigate to the EA, click on EA, and click on Open to import EA into the Strategies box.

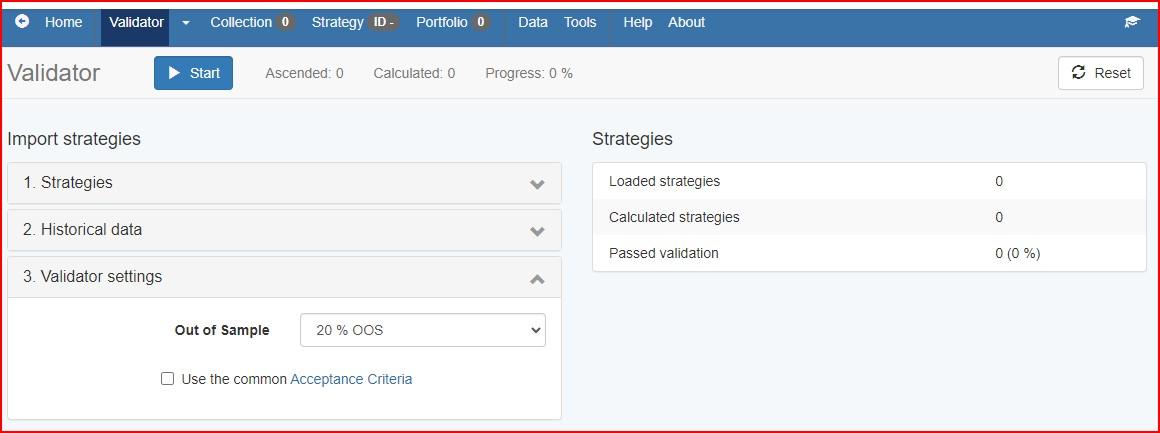

Uncheck the Acceptance Criteria box.

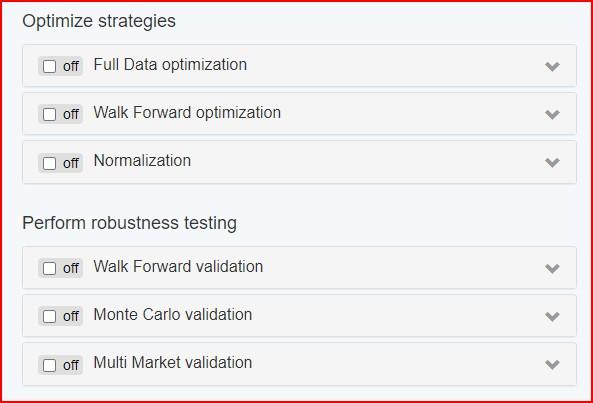

Uncheck all these boxes.

Click on Start and all the EAs will now be back in the Collection.

Alan Northam

ParticipantHi David,

Thanks for adding the link. Petko changed the strategy about 12 days ago in THE COMPLETE FTMO CHALLENGE COURSE but it too has been losing over the last two months. He has not yet updated the course since then.

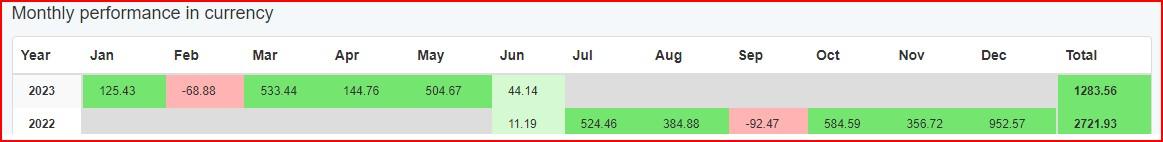

Here is the monthly performance of one of my EAs:

All EAs will go through a period of drawdown where it will not make any profit for a month or so. Notice after going through a drawdown the following months are usually quite profitable. So times when I start a prop firm challenge I go through the whole month losing and the account ends up as a failure. I then repeat the challenge and usually on the second or third time I pass the challenge. I have just started a new Evaluation with MFF (same as FTMO Challenge phase). You can find it in the forum on Prop Firms. There you can read my plan. I plan on updating it weekly with my results. I encourage you to follow along to see how I progress.What I am trying to share is that nothing is perfect not even EAs. They will all go through a period of drawdown and the better-created EAs will then come back with several months of profit. Here is the performance of one of the EAs I am using in the MFF Evaluation:

As you can see this EA has been profitable for one year. I show you this to show you can create your own EAs that perform well using EA Studio. Also, notice there were three months where the profit was quite small, notice how much profit it made in the following months. Again this shows that after periods of low profit or drawdowns, the following months are usually quite profitable. So, don’t give up on EAs, in the long run well created EAs are very good at generating profit.

Alan Northam

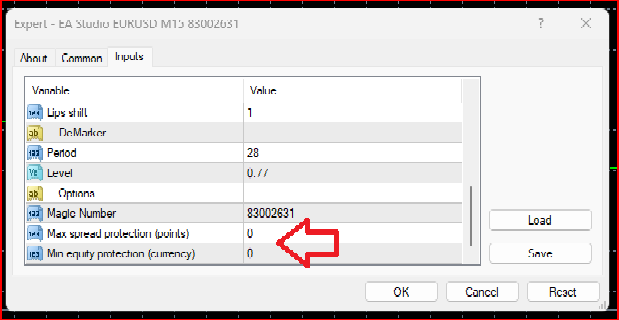

ParticipantApproximately two weeks ago “Max spread protection” and “Min equity protection” was added to the Expert Advisor Properties dialog box.

Let’s look at each of these individually to see how they work:

Max spread protection – The spread, or the difference between the bid and ask price of an asset (currency pair), can be large at times and can affect the daily profits and losses of a trader’s brokerage account. During the first couple of hours following the opening of the foreign currency market each day the spread of assets can become quite large. Further, some FX brokers use variable spreads during the day based on the volatility of the foreign exchange markets. now traders can control the maximum spread to limit the effect higher spreads can have on their accounts. As an example: By setting the “Max spread protection” to 50, traders can now limit the spread to 5 pips. What this means is when the spread increases above 5 pips the Expert Advisor (EA) will not place a trade. The only time when an Expert Advisor will open or enter a trade position is when the spread is below 5 pips.

Min equity protection – There will always be a period of time when an Expert Advisor will undergo a drawdown. Sometimes the drawdown will be shallow and sometimes can be quite severe. This addition to the EA Properties box can help protect a trader’s account from a severe drawdown. As an example let’s see how this works: Let’s say you set the “Min equity protection” to $300. This means that if the equity in your account today is $5000 then the maximum drawdown will be limited to $4700. So here is what will happen: When your account draws down to below $4700 any open position will be closed and the Expert Advisor will be removed from your MetaTrader chart window.

*Always test new options on a demo account before using them on a live account to verify they are working as expected!

**Personally, I do not like the idea of using dollars to set the minimum equity protection. I would rather it be in percent of equity. I have requested this option to be added.Alan Northam

ParticipantDavid, Can you send a link to the free EA so I can check it out for you so I can further address your concerns? Are you using the EA with FTMO?

Alan Northam

ParticipantDavid,

Is it the M15 FTMO bot that Petko posted a few days ago?

Alan Northam

ParticipantHi David,

Yes EA Studio is a great tool for creating EAs for MFF. After creating the EA carefully review the report and study the stats to make sure it doesn’t violate the daily drawdown. Also, check the stagnation to make sure it doesn’t consume too much of your evaluation phase. What I am saying is to review the EA Report in detail to make sure the EA has a good chance of passing the eval phase. Keep us up to date as to how it goes! I would be interested in how things go.

Alan Northam

ParticipantHi David,

You only have a $49 cushion. You would need to be very conservative in your trading or your account could be wiped out, as you say! I don’t think using Waka Waka in its low-risk setting will get you past the target price by July 7. Petko does not recommend using Waka Waka during the FTMO Challenge or Verification phase, only once funded. Even using Waka Waka in a $10,000 funded account would take approximately two years to recover the investment of purchasing Waka Waka before you would start realizing a profit.

Alan Northam

ParticipantDavid,

What were you trading last week?

Alan Northam

ParticipantEA Studio needs these 300 bars so the indicators used in the EA will have a sufficient lookback period so they will start working correctly over the time frame you are interested in observing. 300 bars where each bar is 4hrs indicates you need at least 3 months of data history. Are you using your broker’s historical data? If so you need to maximize the broker’s history data in MT4. If you don’t know how to do that I will provide a link to a video to show you how this is done. The other option is to use the Premium Data in EA Studio.

Alan Northam

ParticipantPetko,

You have not updated the link attached to The Robot button in lesson 9.3 :o)

Alan Northam

ParticipantEvan P. – I just checked the indicators FSB uses and did not find a Gann Box indicator. FSB uses its available indicators to generate EA’s.

June 15, 2023 at 9:58 in reply to: Why Can’t I Export More Than 100K Bars On MT5 Export script #176171Alan Northam

ParticipantJaylon: The problem with downloading the historical data from MT4 or MT5 is that the broker usually doesn’t provide much data. To make sure you are downloading the maximum possible data from your broker follow the procedure as explained by in the following video:

If the maximum data available from your broker is not sufficient to do the required backtesting then Petko has another procedure you can use to get more data to use so you can get a reliable backtest over your required lookback period. See the following video:

Alan Northam

ParticipantAccording to the Waka Waka stats it had averaged 7.18% profit per month and has a maximum drawdown of 26.7%. It also touts every month for the last five years had been profitable. Since the average profit per month is 7.18% it stands to reason that some months produce less than 7.18% per month and some months more than 7.18%. Also it stands to reason, since every month has been a winning month, some months could produce a profit below 1% but greater than 0% with a risk every month of having a 26.7% drawdown. To adjust the risk so that the maximum drawdown is less than 5% so as not to fail the FTMO drawdown requirement and close the account also means to have a smaller monthly profit to well below 7.18%. So by reducing the risk therefore would indicate that the monthly profit would be too low to pass the price target to complete the Challenge or the Verification phase. As a result I don’t see how this EA can be used to pass the Challenge or the Verification phase. I do see how it can be used in a very low risk / low profit funded FTMO account. If the funded account performance Petko has shown above is for one month then it represents a monthly profit of about 0.7%.

Alan Northam

ParticipantWhen I look at the EA Petko used for FTMO and shared in his FTMO course from March 2022 until March 2023 I see it had three losing months. Keep the faith, perhaps next month it will start winning again! Since you are doing the Verification stage perhaps you should just manually trade and not us the FTMO EA. You can also ask support it you don’t meet the price target requirement of the verification stage before time runs out will they give you a second chance. If they will then you might run the FTMO EA with a 0.01 lot size until it starts showing profit again and then increase the lot size once it starts to become profitable. Just an idea! Good luck with your verification stage!

Note: Don’t change the time frame use the time frame for which the EA was designed for. Changing the time frame may result in poor performance!

-

AuthorPosts